What does optimizing data-to-learning-to-action processes have to do with the Finance organization? Admittedly, at first blush, data-to-learning-to-action sounds like techy, data science-based stuff; not exactly the traditional area that finance executives would be directly concerned with. But, on the contrary, optimizing data-to-learning-to-action is fundamentally about business performance improvement. And second, it is all about measuring performance opportunities and results in terms of financial value. So, optimizing data-to-learning-to-action really has everything to do with the concerns of finance executives.

One of the motivations I discuss in the book for why we need a new method for improving business performance is the deterioration of key metrics of business performance, such as return on assets, a metric of critical concern to CFOs. Return on assets of US businesses in the aggregate has been trending downward for many decades. This despite all the waves of new technologies that should be helping the metric, as well as the general shift toward services that should also be working to increase returns on assets. Clearly the conventional approaches to performance improvement have not been generally working.

The data-to-learning-to-action method is designed to do what the conventional approaches have demonstrably failed to do, maximize the long-term financial well-being businesses. And given this objective, the method starts with first principles and then simply follows the logical conclusions that are derived from these first principles.

The first question the method poses, from which everything else inevitably follows, is: what is the most important driver of long-term financial performance? We answered that question in the previous blog as follows:

It’s the effectiveness of decisions. That’s what the data tells us, but it’s also just plain common sense. How can it not be the case that ultimately financial performance is a function of the effectiveness of an organization’s decisions? What else could it possibly be? It’s not necessarily quality or efficiency, it’s not digital transformation, it’s not even people. Those are subsidiary because they are examples of outcomes of decisions or the means for potentially making more effective decisions. When it comes to directly driving performance, it’s the overall effectiveness of an organization’s decisions that rules. This is so obvious when you really think about it, but it is so often overlooked or just taken for granted by organizations.

Given that the driver of long-term performance is decision effectiveness, the first phase of the method simply comprises a series of inevitable conclusions that result from applying the basics of constraint theory, summarized as follows:

• The key driver of financial performance is decision effectiveness

• Decision effectiveness is driven by the performance of the associated data-to-learning-to-action processes

• The performance of a data-to-learning-to-action process is governed by its limiting constraint

• Solutions (and ONLY those solutions) that resolve the limiting constraint deliver quantifiable value by increasing decision effectiveness

• Continuous performance improvement is achieved by then identifying and resolving the next series of limiting constraints

This phase of the optimizing data-to-learning-to-action method tells us where and how to focus our attention and resources to improve business performance: by identifying and resolving constraints in the data-to-learning-action processes associated with high-leverage decisions.

But we also need to know what the expected value is of improving decision effectiveness. For that we need only to turn to some fundamentals of decision science, and recognize that if we resolve a constraint in a data-to-learning-to-action process such that the associated decision will change, then we can calculate the expected financial value of that change of decision from what it otherwise would be. We can most generally call such a constraint resolution that causes a different action to occur, actionable learning. Actionable learning always has positive value and it can be quantified financially.

Therefore, applying our method we can rigorously determine the expected value of solutions that will improve decision effectiveness, and thus, long-term financial performance. These solutions will be improvements associated with applications of mixes of people, processes, and/or technology. In today’s world of such rapid technological advances there is justifiably significant focus on the technology-based opportunities, but people and processes are almost always important factors as well.

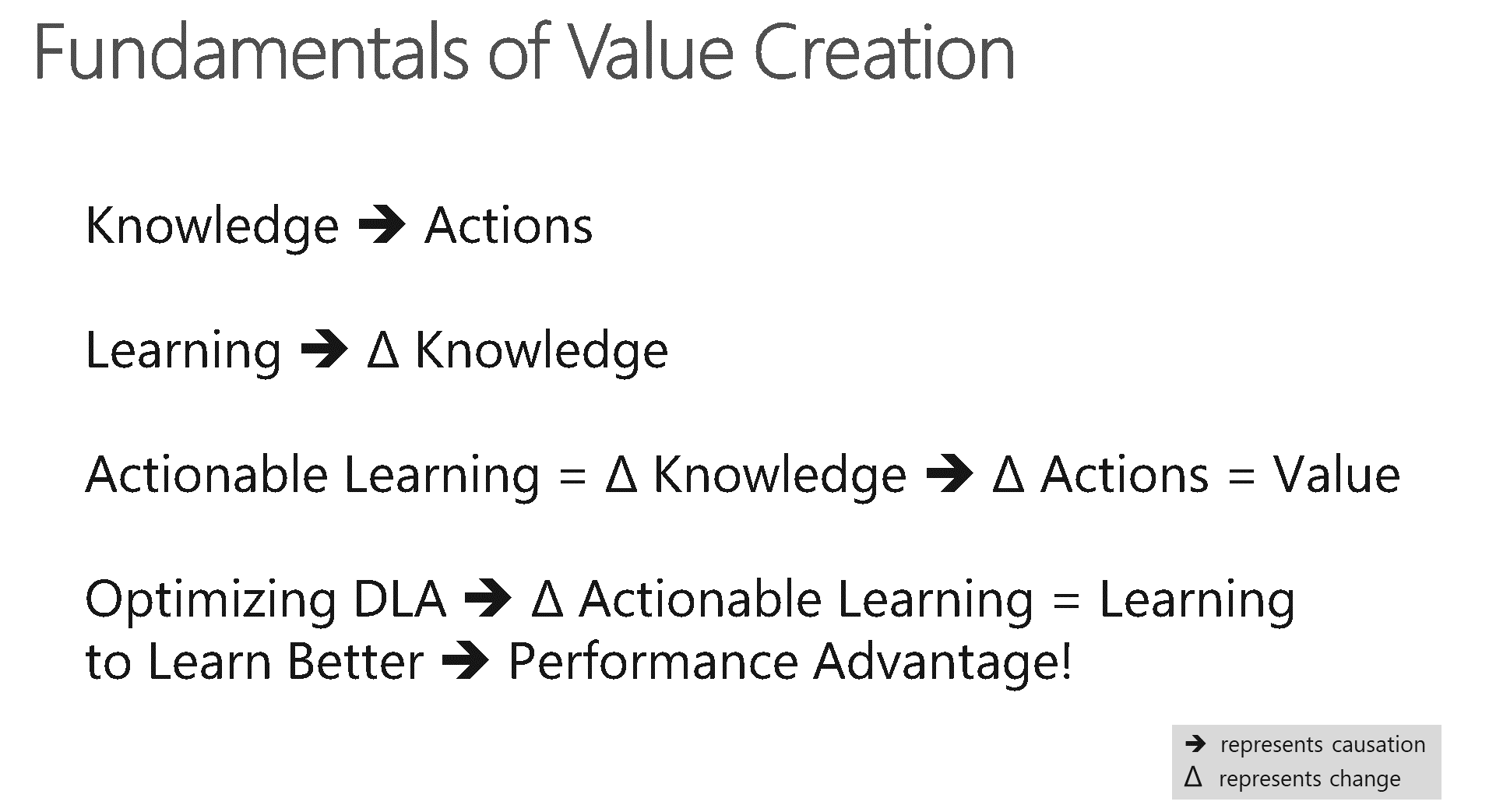

Notice that all we have really done so far is follow a path of incontrovertible logic! Let’s follow the logic further as summarized by the following quasi-mathematical diagram. A given state of knowledge causes a given set of actions to occur (and knowledge can be thought of as a form of information that is actionable). Learning causes a change (increase) in the state of knowledge. A special type of learning, actionable learning, changes knowledge such that actions also change. And as we have seen, actionable learning has tangible, quantifiable value.

When we optimize data-to-learning-to-action processes by resolving constraints, we are increasing actionable learning, which is equivalent to learning to learn better, which has always been understood to be the only way to achieve sustainable performance advantages! We have simply made this insight into more of a science than an art form.

In business school we learn that the value of a firm (theoretically if not practically) is the discounted cash flows of all the firm’s opportunities (i.e., decisions) given the current state of knowledge. Without any changes in the state of knowledge, the decisions and value remain the same (assuming the business environment remains fixed). Actionable learning changes the state of knowledge such that decisions and resulting actions change. All value can therefore be attributed to the actionable learning that generates the new knowledge (otherwise we would be double counting if both the learning and the resulting knowledge accrued the value).

In other words, all value generated by a business ultimately derives from learning, specifically actionable learning. We don’t always think about business value that way, but we have just proved that it is so! And that’s why optimizing data-to-learning-to-action is so powerful, because it focuses on the engine of value, actionable learning, and in a quantifiable way. That’s something agile, lean, quality improvement, process redesign, digital transformation, and so on, cannot do, at least by themselves. But they can do so when performed in conjunction with optimizing data-to-learning-to-action, and that is an opportunity for CFOs to lead!

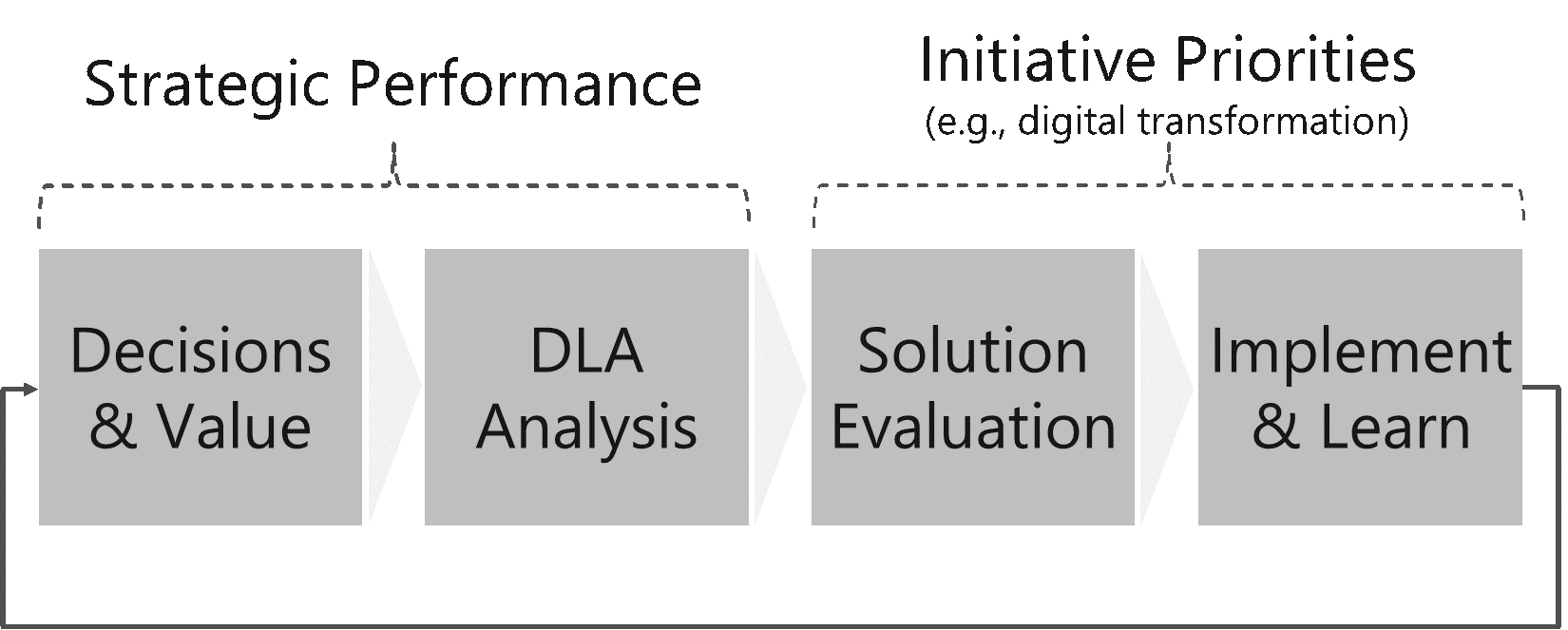

The following diagram crystallizes further the opportunity for the CFO to lead the performance improvement agenda. The optimizing data-to-learning-to-action method can be categorized into four main phases. First is Decisions and Value, which is about determining the highest leverage decisions to work to improve and the value opportunity of doing so. Second is the detailed analysis of the data-to-learning-to-action (DLA) processes that are associated with each of the high-leverage decisions. Third, people-process-technology solutions are evaluated to address constraints in the data-to-learning-to-action processes. And fourth, solutions are implemented, the results measured, and the associated learning that occurs is included in the next iteration of applications of the method.

The first two phases of the method are initiative-agnostic—they universally apply to improving business performance. They provide the required value guidance for the solutions that will be evaluated and implemented, whether those solutions are part of a digital transformation agenda or other agendas such as agile, lean, quality improvement, etc. Hence the CFO’s natural accountability for business value positions them for leadership of the first two phases of the method, which complements and steers all other initiatives, thereby ensuring these initiatives are truly value driven.

In summary, the CFO is the key role for assuring overall business value. The optimizing data-to-learning-to-action method is the business performance method that is fully centered on value. Hence the opportunity for the CFO to ensure all the businesses initiatives are fully aligned with value by championing the data-to-learning-to-action method.

Leave A Comment