Organizations are continuously confronted with a bewildering array of opportunities for potentially creating value. Unfortunately, quite often a significant portion of the value potential of the opportunities is not quantified, or even explicitly considered. Which means that prioritization of the opportunities is bound to be faulty; i.e., the most deserving opportunities don’t always get the funding. Proper prioritization and overall portfolio management requires an explicit understanding and quantification of the full value of each of the opportunities, or what I call Total Value.

What’s so often missing is the learning value associated with the opportunity. That’s one reason that the data-to-learning-to-action method has such a strong focus on value that is attributable to learning. But the primary reason is that the opportunities for enhancing decision effectiveness through enhanced learning are ultimately the bigger opportunities because they are the long-term drivers of value for an organization. There are certainly also non-learning-based value-generating opportunities such as pure efficiency opportunities–reducing costs while maintaining the same output levels or increasing output without increasing costs. But the caution is that even these opportunities should still be pursued in the context of understanding limiting constraints of data-to-learning-to-action processes, otherwise there can be unpleasant unintended consequences from such seemingly simple efficiency-based opportunities.

Most generally, projects and activities can comprise a mix of learning value that improves decisions and other value that is attributable to enhanced efficiency, better quality, and so on, which we can term direct value. In other words, the Direct Value of a project or activity is its value given the current state of knowledge (i.e., current level of uncertainty). The value of increasing knowledge (reducing the current level of uncertainties) is the Learning Value. Put most simply, if a decision changes, it is Learning Value; if a decision remains the same but is performed, e.g., more efficiently, it is Direct Value. So, the proper way to manage and prioritize investments of attention and resources is via Total Value, which is Direct Value plus Learning Value (all net of costs and in the form of discounted cash flows):

Total Value = Direct Value + Learning Value

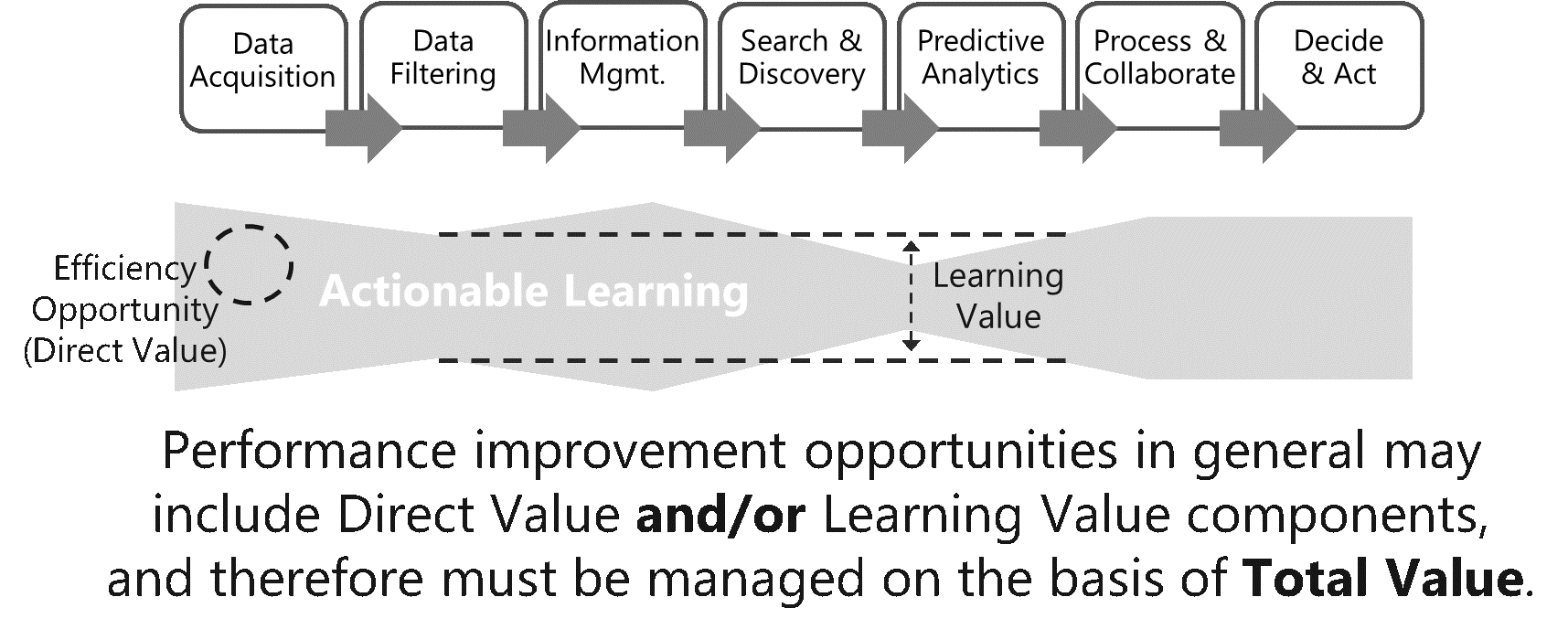

This composite value of a project or activity can be illustrated using our standard data-to-learning-to-action diagram. Resolving the limiting constraint in a data-to-learning-to-action process to improve decisions is the learning value component of the total value. And, for example, an enhanced efficiency opportunity in the data-to-learning-to-action process constitutes a direct value component.

So, what an organization needs to maximize is the Total Value given the portfolio of opportunities and its monetary and resource constraints. That ensures maximum shareholder value because it accounts for both short-term opportunities and opportunities for longer-term sustainability.

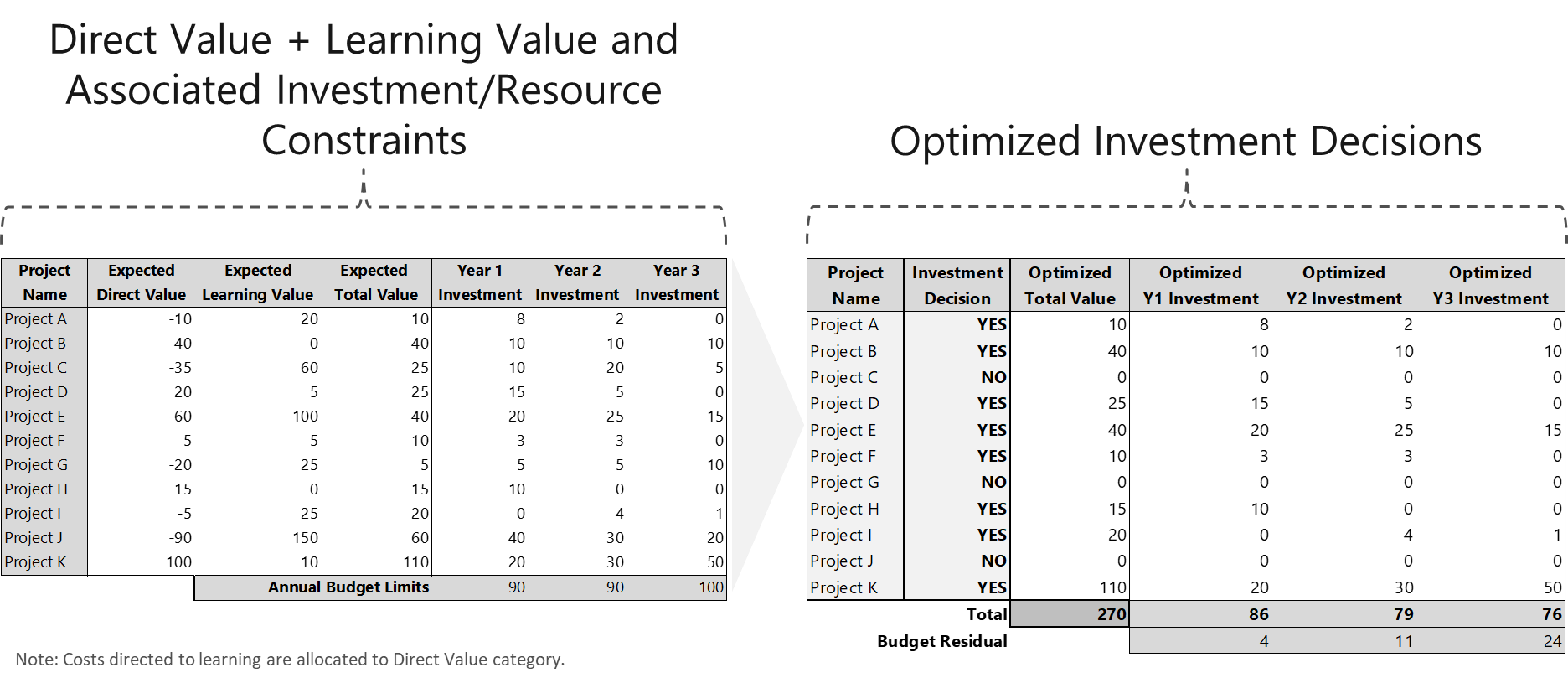

In a world without budgets 😊, if the Total Value of an opportunity is positive, then it should be pursued. In our real world, there are inevitably budgets or other types of resource constraints, and so the Total Value of the organization’s portfolio of opportunities has to be maximized conditional on the budget and resource constraints. To do so is a simple matter of putting the Total Values and associated constraints in an optimization model and solving for the portfolio that maximizes Total Value, such as illustrated in the following toy model.

With the Total Value concept, we have a fundamentally new approach to the disciplines of managerial economics and managerial finance. Traditionally in these disciplines the focus of the various techniques is slanted toward the Direct Value category because that type of value is most easily quantified. Learning value is often ignored, or, if there is any quantified focus on it, it is buried within one-off decision analyses. And therefore, since Learning Value is actually the dominant source of value over the long-term, traditional methods fail to maximize long-term value. In the previous blog, I discussed reasons why CFOs are a natural to take the lead on the data-to-learning-to-action method in their organizations. The concept of Total Value is another reason–CFOs must insist on managing the business based on Total Value as only it assures maximum financial performance over the long-term.

Leave A Comment